The custom home industry is a realm where creativity converges with craftsmanship, resulting in personalized living spaces that captivate the senses. Yet, much like any other sector, it isn’t immune to economic fluctuations, especially those related to interest rates. In this blog post, we’ll explore the impacts of elevated interest rates on the custom home industry, shedding light on how builders and consumers can adapt effectively to these shifts.

Understanding the Impact of Elevated Interest Rates

Custom homes stand as distinct expressions of individuality, meticulously designed to cater to the unique needs and desires of homeowners. The collaborative process among homeowners, architects, designers, and builders fosters a home that mirrors the preferences of its occupants. However, elevated interest rates can introduce subtle yet significant changes to various aspects of this intricate journey.

Custom homes stand as distinct expressions of individuality, meticulously designed to cater to the unique needs and desires of homeowners. The collaborative process among homeowners, architects, designers, and builders fosters a home that mirrors the preferences of its occupants. However, elevated interest rates can introduce subtle yet significant changes to various aspects of this intricate journey.

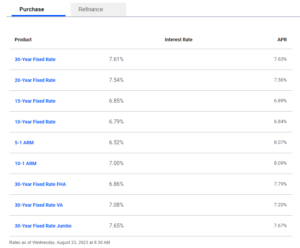

Interest rates hold the reins in shaping consumer decisions, influencing buying power in more ways than meets the eye. While interest rates might be a familiar concept, their potential influence on buying power might not be as clear. Buying power encompasses the range of goods, services, and acquisitions an individual can afford with their financial resources. Income, expenses, inflation, and interest rates are pivotal influencers on buying power. When interest rates rise, borrowing costs for consumers escalate, prompting some potential buyers to recalibrate their custom home plans to align with their budgetary constraints.

Embracing Adaptation in the Face of Change

Adaptation takes center stage as the guiding principle for both builders and consumers alike. While historical low interest rates have been a boon, we must recognize that fluctuations are an inherent part of the economic landscape. Today’s rates, although higher, are still historically favorable. It’s crucial to contextualize these figures within a broader historical perspective.

Reflecting on the past, interest rates have witnessed significant fluctuations. In the late 2000s, during the housing crisis, interest rates were between 5-6%, while the 1990s experienced rates between 11-13%. The context is essential, reminding us that rate shifts aren’t the sole determinants of market dynamics.

Shifting Mindset: Buying Power over Interest Rates

A paradigm shift is in order – from fixating on interest rates to focusing on buying power. By understanding and optimizing our buying power, homeowners can make conscious choices about home size, design efficiency, and functionality. Elevated interest rates can indeed nudge us to think more strategically about our home choices without compromising our vision.

Builders and Buyers Navigating Change Together

The custom home industry is a realm of adaptability, creativity, and resilience. Elevated interest rates introduce a new dimension, challenging both builders and consumers to rethink strategies. While obstacles may arise, they’re also opportunities for innovation. By embracing change and making informed decisions, both builders and buyers can navigate the shifting landscape.

Bringing Dreams to Life with eNg Designs & Construction

At eNg Designs & Construction, we’re committed to helping you realize your custom home dreams. Visit our website and social media platforms to learn more about our services and reach out for a free consultation. Let’s navigate the evolving landscape together, ensuring that your personalized dream home remains within reach, regardless of economic fluctuations.